First, there was the euphoria that a federal judge was finally upholding the rule of law.

Mueller Gets a Smack Down by Federal Judge

But we knew it was too good to be true and started looking at just who was Judge T. S. Ellis the Third and found this:

T. S. Ellis III: Wolf in sheep’s clothing?

AIM4Truth Lynn wrote us in response: “You’ve just ruined two happy days.” Unfortunately, Lynn, we have more bad news. Check out Ellis’ pedigree.

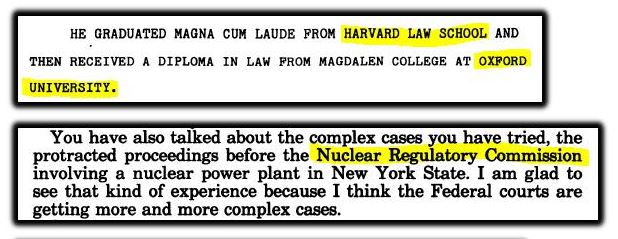

.

Source: S. Hrg. 1009, Pt. 3. (Jul. 21, 1987). Thomas S. Ellis, III Confirmation Hearing, Judiciary Committee. Ser. No. J-100-9. U.S. Senate.

Annual Avg. Increase in Financial Investment Holdings (1987-2010) (23 years)

$1,295,000-$111,289=$1,1837,11 / 23 = $51,466 per year increase (even through the 2008 banking crash)

Source: Thomas S. Ellis, III. (2010). Financial Disclosure. U.S. Courts.

Read: When one becomes a judge, one also becomes a brilliant investor.

It is magical how that works, isn’t it?

Sidenote from an AIM4Truth reader who was a Boeing engineer:

An engineer at Boeing in 23 years could not make this type of returns with the Boeing VIP, unless the Boeing contribution was maxed out at 15% each year based on the salary, which is comparable to a Federal Judge. Only if a person makes ‘cash’ contributions, and rolls over all dividends can these types of returns be made consistently. The smart engineers moved in and out of the growth portfolios, but could only make so many moves per year. I did really great with Tech stocks, and before it busted, I moved to ‘bonds’ completely to ride out the storm. I then moved into a balanced growth fund with housing, and moved out before the bust, into Boeing stock portfolio as a ‘protection fund’, and I was good friends with some smart Lebanese engineers, who knew how to invest. A engineer who invested in the VIP at max, and also made cash contributions, after 30 years, usually walks away with $1.5M, plus retirement, plus medical until Medicare.

http://www.NROTC.Navy.mil/scholarships.HTML

Ellis CV gap 1961 to 1966 might indicate unspecified Navy/Marine service, and Aeronautical Engineer a clue. We can hope, pray that Ellis has been in contact with many White Hats and is subject to Patriot conversion….

God Make America Great Again

” When one becomes a judge, one also becomes a brilliant investor. ”

The S&P 500 went from 264.5 on 1/1/87 to 1123.58 on 1/1/2010 , so his returns were on average only a few percent per year greater than if he had invested in an index fund. That doesn’t necessarily indicate either investing brilliance or insider trading skulduggery , though it also doesn’t rule out either of those explanations. He may have simply been a better-than-average investor with better-than-average luck.

If he’s really a “brilliant investor” of the sort that’s common in D.C. , most of his wealth is obscurely tucked away in offshore havens anyway , far from our prying eyes.